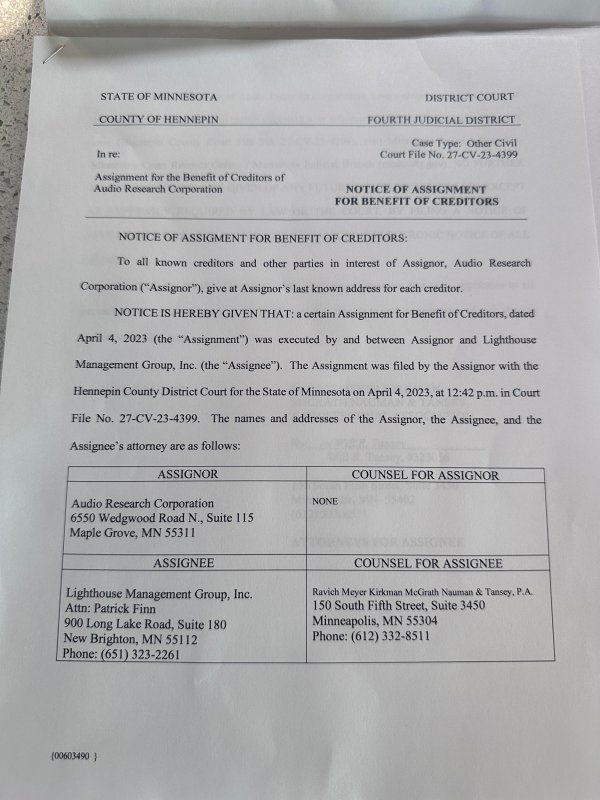

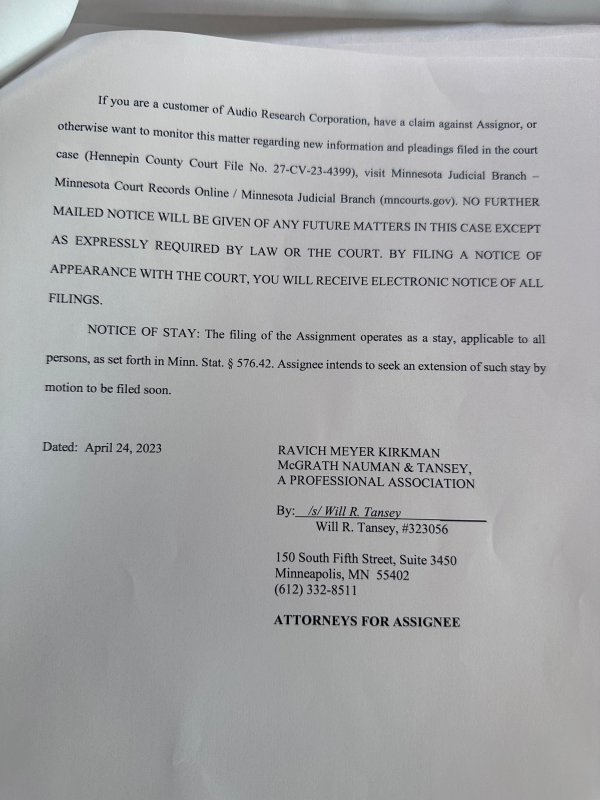

I reviewed the Assignment filed on April 4 in state court. Audio Research voluntarily agreed to assign all of its assets to a receiver, Lighthouse Management Group, Inc. Lighthouse Management is in the business of working with troubled businesses and regularly acts as a receiver. This process is an alternative to a bankruptcy filing in federal bankruptcy court; however, any three creditors can seek to place Audio Research into an involuntary Chapter 7 bankruptcy in federal bankruptcy court. This might occur if three creditors do not trust the process or the company’s strategy in state court. Schedule B attached to the Assignment is 31-page, single-spaced list of creditors which includes many familiar names in the audio industry. The job of the receiver is to liquidate the assigned assets, collect all proceeds, pursue any claims, pay and discharge all expenses of the liquidation, and then pay and discharge (to the extent of available funds) all debts and liabilities of Audio Research. Sufficient funds may or may not be available depending on the sale proceeds and the amount of the debt. Unlike a bankruptcy filing, there is no statement of the amount of the debt in the state court filing.

The receiver has complete control and power of attorney over the assets of Audio Research. It is likely that, to maximize proceeds, the receiver will seek to sell the entirety of the assets and business (including goodwill) as a going concern; if that effort is successful, the business may continue under the ownership of the buyer. It is also possible that Audio Research already has a transaction agreed upon in place for the sale of its assets and business (including goodwill) as a going concern to a “white knight” and the filing with state court is intended to facilitate that transaction without an involuntary bankruptcy filing. I expect that Audio Research has already been (or soon will be) communicating with creditors. The argument will be that the “white knight” buyer will only contribute funds if Audio Research is not forced into bankruptcy and a bankruptcy will yield far less value for creditors.

Having owned and enjoyed many Audio Research products for many years including, most recently, the Ref 160S Amplifier, Ref 6SE Preamplifier, and Ref 3SE Phono Preamplifier, I find this turn of events to be unfortunate. Hopefully it will result in better things to come under new ownership. It seems, however, that the effort by Audio Research to appeal to a broader range of customers with the lower priced I/50 was not successful.