Finances | Business | Investments | Tesla Shares

- Thread starter NorthStar

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

A typical standard question in investing in a business is what is the barrier to entry. For crypto as a business, it appears to be very low, given the large number of competitors in this space. The explosive growth of NFT's has also become the next big thing with almost no barrier to entry where fortunes are made and lost in a matter of a few days, hours, minutes or even seconds.

Larry

Larry

To me its merely cheap money / low interest rate exuberance .

When this massive bubble finally pops ( which could well be this year )

Most of those businesses will collapse as well

When this massive bubble finally pops ( which could well be this year )

Most of those businesses will collapse as well

Tomorrow inflation numbers .

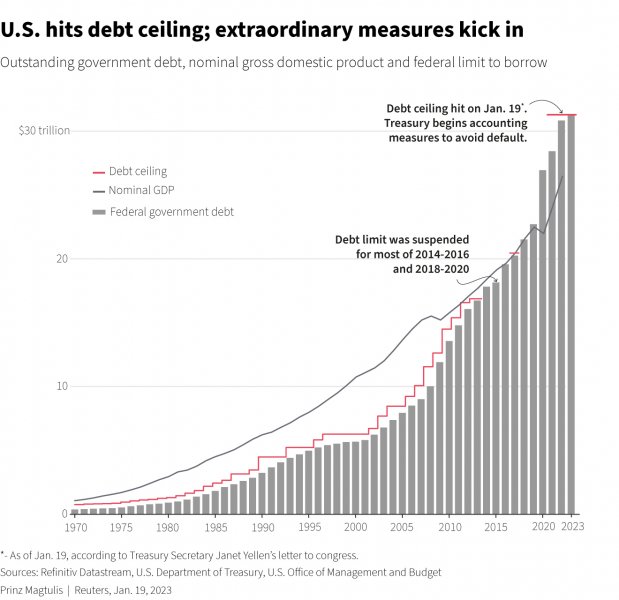

Remember paul Volcker had to hike rates to 20 % in the 70 - 80 s to curb the inflation .

There is no way they could do that now , the world is loaded on debt because of 10 - 12 years of 0 % rates .

This is gonna end very bad for the average blue collar worker ,..... in Gold we trust.

I already made a small fortune since the start of the year .

I think this year ( next year max ) , we re gonna see gold explode higher .

When the people figure out there is no way the FED can curb the inflation and instead is doomed to keep printing all hell will break loose

Remember paul Volcker had to hike rates to 20 % in the 70 - 80 s to curb the inflation .

There is no way they could do that now , the world is loaded on debt because of 10 - 12 years of 0 % rates .

This is gonna end very bad for the average blue collar worker ,..... in Gold we trust.

I already made a small fortune since the start of the year .

I think this year ( next year max ) , we re gonna see gold explode higher .

When the people figure out there is no way the FED can curb the inflation and instead is doomed to keep printing all hell will break loose

Last edited:

I think were getting close to the Fed pivot , and were my strategy is finally going to work .

Most likely in the next 2 months .

If the FED hikes another 1 % in sept you could see a major downturn in the market ( it probably already started ) , there is no way they can curb inflation , as that would mean raising rates above the inflation rate.

Imagine interest rates at 10 % for businesses , mortgages , loans in general everything would grind to halt , the chickens have finally come home to roost

Most likely in the next 2 months .

If the FED hikes another 1 % in sept you could see a major downturn in the market ( it probably already started ) , there is no way they can curb inflation , as that would mean raising rates above the inflation rate.

Imagine interest rates at 10 % for businesses , mortgages , loans in general everything would grind to halt , the chickens have finally come home to roost

Last edited:

In a moment were gonna have a laugh /joke .

The ECB will raise rates with probably 0,5 % , add this to the 0,5 % we already have and we end up with 1 % while the inflation rate is 10 % .

This whole europroject is basically still holding together because we have low rates ( for 12 years )

Where were the days before this EU fiasco with the strong Dutch Guilder and the German D mark.

Corrected we had 0,50 we now have 1,25 %

The ECB will raise rates with probably 0,5 % , add this to the 0,5 % we already have and we end up with 1 % while the inflation rate is 10 % .

This whole europroject is basically still holding together because we have low rates ( for 12 years )

Where were the days before this EU fiasco with the strong Dutch Guilder and the German D mark.

Corrected we had 0,50 we now have 1,25 %

Last edited:

Tomorrow interest rates again , will it be 0,75 or 1 % ?

I wouldnt be surprised if the stockmarket took another 15-20 % beating

I dont even wanna talk about the gold / silverminers if thats the case

I wouldnt be surprised if the stockmarket took another 15-20 % beating

I dont even wanna talk about the gold / silverminers if thats the case

But i doubt its gonna last long these FED actions , ..... something bad is gonna happen in these debt driven markets before years end

Example :

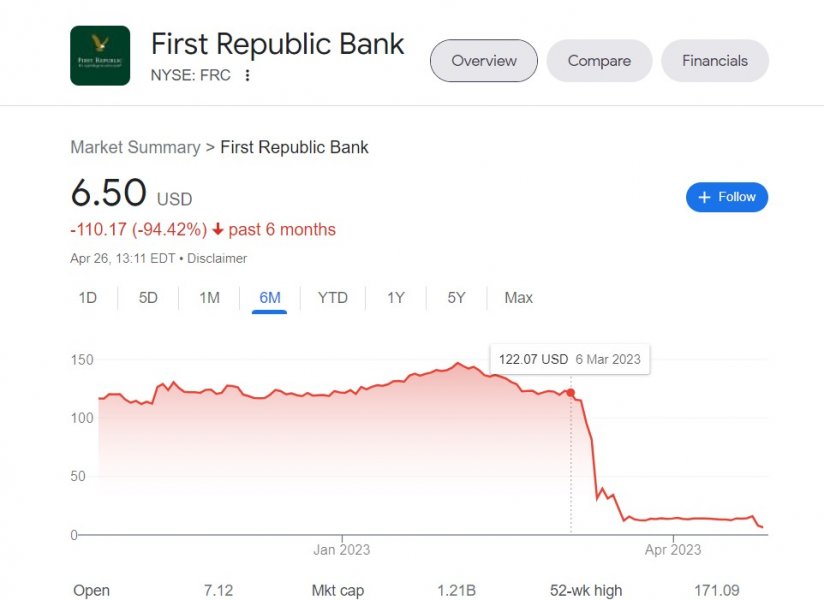

The 30-year mortgage rate dropped to a new historical low of 2.68% by December of 2020. In 2021, mortgage rates hovered between 2.70% and 3.10%, which gave many borrowers the chance to refinance or purchase properties at the lowest rates on record.Jan 18, 2023

With banks now needing to refinance loans at 4.75% to 5.00% fed funds rate you dont need to be a genius to figure out where this is gonna end .

Next in line

www.businessinsider.com

www.businessinsider.com

Please FED pivote already , no need to play tough anymore and fight inflation the chickens have come home to roost

The 30-year mortgage rate dropped to a new historical low of 2.68% by December of 2020. In 2021, mortgage rates hovered between 2.70% and 3.10%, which gave many borrowers the chance to refinance or purchase properties at the lowest rates on record.Jan 18, 2023

With banks now needing to refinance loans at 4.75% to 5.00% fed funds rate you dont need to be a genius to figure out where this is gonna end .

Next in line

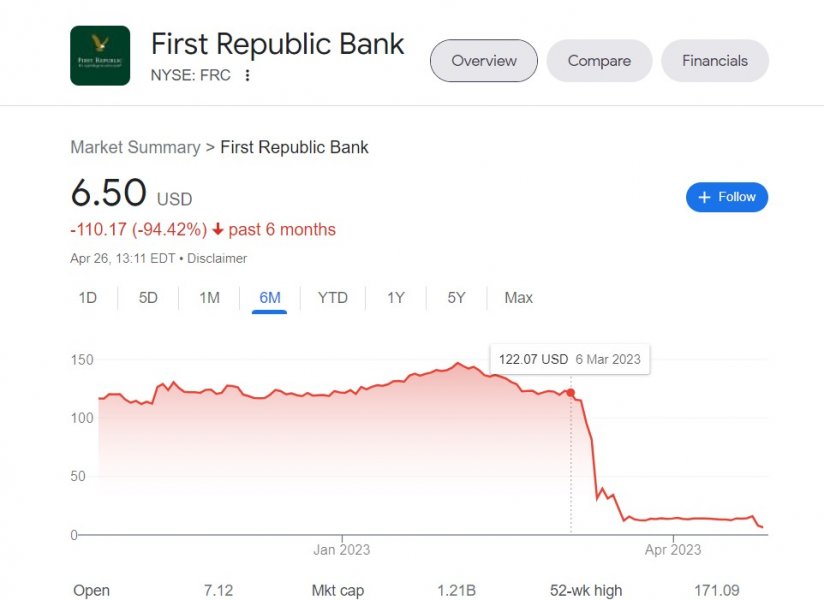

First Republic handed out billions in ultra-low-rate mortgages to the wealthy. It backfired horribly.

The bank is now fighting for its survival, after its strategy of winning over wealthy clients with huge mortgage loans went wrong.

Please FED pivote already , no need to play tough anymore and fight inflation the chickens have come home to roost

Last edited:

I keep buying Gold / Silver miners .

My estimation /prediction for what its worth .

Bank troubles are far from over.

Commercial real estate is in trouble

Recession on the horizon.

Imv there is no way they re gonna be able to keep raising rates in a debt filled economy without breaking something

My bet is the FED is gonna pivot before years end , and Gold / silver miners are going up faster and higher then Elon musks space rocket.

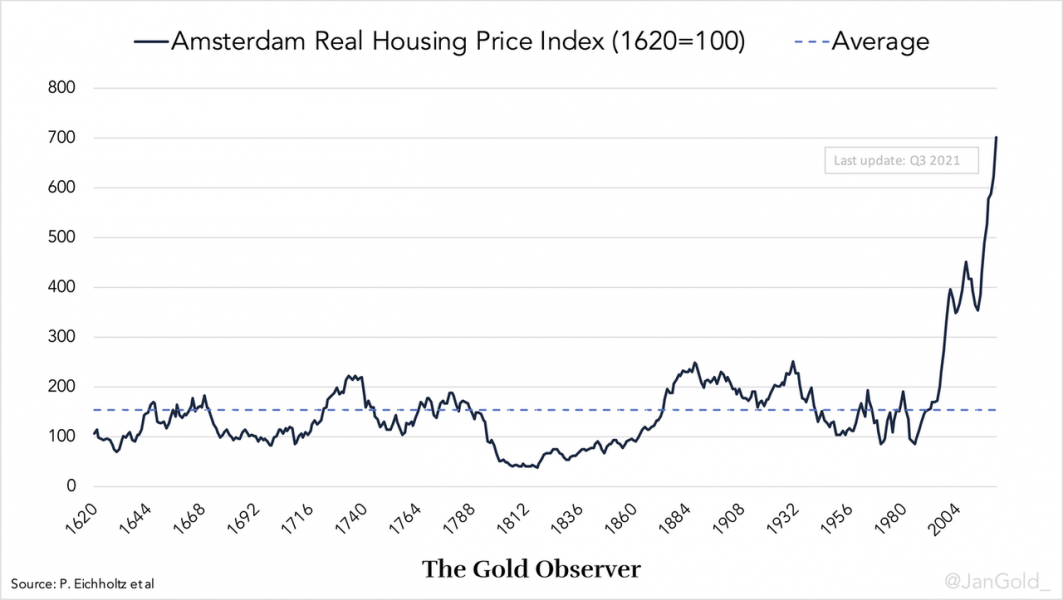

I sold my last real estate in august last year which was the top , sometimes you get lucky with timing

My estimation /prediction for what its worth .

Bank troubles are far from over.

Commercial real estate is in trouble

Recession on the horizon.

Imv there is no way they re gonna be able to keep raising rates in a debt filled economy without breaking something

My bet is the FED is gonna pivot before years end , and Gold / silver miners are going up faster and higher then Elon musks space rocket.

I sold my last real estate in august last year which was the top , sometimes you get lucky with timing

Last edited:

Just as planned so far , potential crash mode for the indexes , is the debt bubble finally bursting ??

I bought a lot more Put option contracts , sept expiration .

My play :

I think we will bounce at around Dow 2900 ( okt 22 low) .

Then close half of the position and roll the rest over for oktober contracts .

With the rest rest get in again around dow 3200 ,..... target March 2020 low , AEX 400 in oktober

Disclaimer .... this is gambling .

.

I bought a lot more Put option contracts , sept expiration .

My play :

I think we will bounce at around Dow 2900 ( okt 22 low) .

Then close half of the position and roll the rest over for oktober contracts .

With the rest rest get in again around dow 3200 ,..... target March 2020 low , AEX 400 in oktober

Disclaimer .... this is gambling

Last edited:

Doubling down on puts , year over year core inflation slightly up despite the rate hikes .

Tomorrow a disappointing jobs number might result in a sell off

Tomorrow a disappointing jobs number might result in a sell off

Rolled everything over to oktober series puts, with a small loss

First over 1 % down day , i would nt be surprised if the 2023 stockmarket crash has begun , even more chance when the fed hikes next week because of the inflation uptick

First over 1 % down day , i would nt be surprised if the 2023 stockmarket crash has begun , even more chance when the fed hikes next week because of the inflation uptick

Last edited:

Similar threads

- Replies

- 39

- Views

- 8K

- Replies

- 13

- Views

- 8K

- Sticky

- Replies

- 41

- Views

- 26K

- Replies

- 23

- Views

- 11K

| Steve Williams Site Founder | Site Owner | Administrator | Ron Resnick Site Owner | Administrator | Julian (The Fixer) Website Build | Marketing Managersing |