What's going on with the US stock market lately?

- Thread starter ack

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Well i ve finally given up on the fact that i can succesfully trade the market with naked options, the market is to unpredictable .

But quit no , only optionstraddles from now on , hedge in place with maximum profit in the most volatile conditions, up or down it doesnt really matter .

But quit no , only optionstraddles from now on , hedge in place with maximum profit in the most volatile conditions, up or down it doesnt really matter .

I am still 100% in, and I am still 100% uncertain as to what is going on, just like back in 2013, when I started this thread. It looks like that, similar to 2013, people are eager to invest after long periods of stagnation.

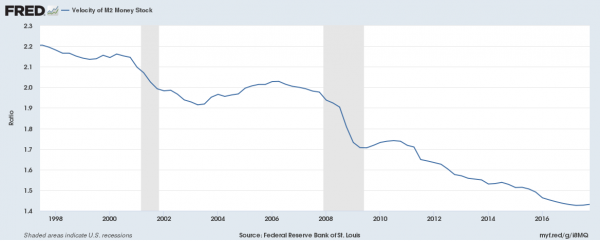

With all the QE and slow growth of the past 10 years money velocity fell through the floor. Any sign of animal spirits like those induced by tax cuts and a more business friendly regulatory environment points to inflation. I am not saying that's a totally bad thing especially when you are $20 trillion in the hole.

There’s obviously not a lot of rationality to that much of a gain (except for maybe the financial stocks with the deregulation happening), though corporate profits have been by-and-large good. I’m skeptical that the tax plan is good for the economy/ market, particularly as it will very likely diminish middle class buying power, if not now, then fairly soon. Particularly for those of us in blue states with typically higher state and property taxes. Further, the market has over the last several administrations done overall better under the Dems and policies that weren’t ‘trickle down’

Looks like rising rates finally sunk in , i think also that because Yellen. Is gone uncetainty hits the market.

With all the QE and slow growth of the past 10 years money velocity fell through the floor. Any sign of animal spirits like those induced by tax cuts and a more business friendly regulatory environment points to inflation. I am not saying that's a totally bad thing especially when you are $20 trillion in the hole.

You can't send money velocity through the floor indefinitely without eventually inspiring economic activity which increases expected inflation which increases interest rates which increases discount rates which reduces the present value of corporate cash flow which equals stock prices.

Last edited:

I hope to ride my march put Contracts out till. S en p. 2140 area for the bounce. If we ever. Get there off course, if we get there. Full in the calls

This stockmarket gambling is useless really, made a big bet on goldstocks instead.

No derivates just stocks

No derivates just stocks

Last edited:

Next week is critical....if we can't rally,then watch out because a 3 of 3 would be on tap. The last 2 weeks have left 2 bearish belt holds on the weekly chart after a small rally. The same fractal existed in 2008 just before the major decline. Friday's low volume is bearish.

Here are the weekly candle charts of the S&P500. Even though the 2008 top was longer in time and far greater in complexity the same fractal exits 1 down,2 up,2nd wave down,2 up,1 small down,and the 2 bearish belt holds up into resistance with low volume. Because the current drops are simple and quick in time...this could signal a much higher degree than the top in 2008.

Why would the market top and decline here? There are many reasons..interest rates rising in the face of historic credit expansion is never good. From past credit expansions in 1929,1987,2000,2008 either were caused by overly easy credit by the Central Bank i.e. 1929,1987.2000,2008,& 2018. 1929,2008,2018 and were accompanied by vast malfeasance. 1987 and 2018 have also rising interest rates. If we are indeed looking at a bearish fractal here 2018 has all these bearish attributes.

Take this with a grain of salt. The next 3 weeks will give the answer.

Why would the market top and decline here? There are many reasons..interest rates rising in the face of historic credit expansion is never good. From past credit expansions in 1929,1987,2000,2008 either were caused by overly easy credit by the Central Bank i.e. 1929,1987.2000,2008,& 2018. 1929,2008,2018 and were accompanied by vast malfeasance. 1987 and 2018 have also rising interest rates. If we are indeed looking at a bearish fractal here 2018 has all these bearish attributes.

Take this with a grain of salt. The next 3 weeks will give the answer.

Attachments

Couldn't just stand by , AEX put in a double top , went short at 569-570 that's what you call a sharp entry , see where this one goes .

Sold a property in Amsterdam , I m building a large long goldminers position , ....... if peter Schiff is right in the end then

Sold a property in Amsterdam , I m building a large long goldminers position , ....... if peter Schiff is right in the end then

Last edited:

Last edited:

What's going on, what's driving the market recently?

• https://www.fullyinformed.com/stock-market-outlook-for-tue-may-29-2018-weakness-again/

• https://invest-more.com/stock-market-news-for-may-29-2018-may-29-2018/28921/

• https://www.nytimes.com/2018/05/29/business/italy-markets-stocks-bonds.html

• https://www.fullyinformed.com/stock-market-outlook-for-tue-may-29-2018-weakness-again/

• https://invest-more.com/stock-market-news-for-may-29-2018-may-29-2018/28921/

• https://www.nytimes.com/2018/05/29/business/italy-markets-stocks-bonds.html

Last edited:

- Status

- Not open for further replies.

Similar threads

- Replies

- 2

- Views

- 1K

- Replies

- 23

- Views

- 6K

- Replies

- 133

- Views

- 23K

- Replies

- 10

- Views

- 5K

| Steve Williams Site Founder | Site Owner | Administrator | Ron Resnick Site Owner | Administrator | Julian (The Fixer) Website Build | Marketing Managersing |