What's going on with the US stock market lately?

- Thread starter ack

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Yes thats it , and it went through today the shorts get burned i reckon , the dutch market follows the us market more or less , so i use that as a guideline for trading , cheap money and low interest rates and good results pump up the market

Pump and dump

Pump and dump

He's talking about the S&P which made a high of 84 today vs a 52 week high of 87. The question is "Will it go through the 87 high" and will that become a support level.

here we go , someone else is playing the same game.

http://blogs.marketwatch.com/thetell/2013/08/15/soross-biggest-holding-a-bearish-call-on-the-sp-500/

http://blogs.marketwatch.com/thetell/2013/08/15/soross-biggest-holding-a-bearish-call-on-the-sp-500/

......the sky is the limit.

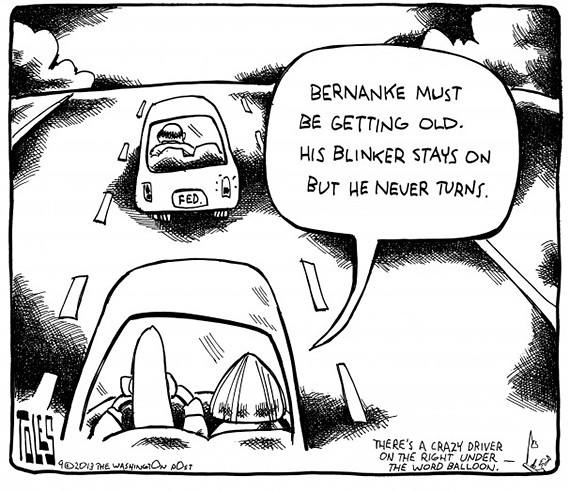

no serious i dont know , but when the fed stops buying completely,the market will set the price\rates in the end

no serious i dont know , but when the fed stops buying completely,the market will set the price\rates in the end

a hindenburg omen is a possible sign `of a market topping, there have been many over the years ,its not really a reliable signal in my opinion

criteria;

These criteria are calculated daily using Wall Street Journal figures from the New York Stock Exchange for consistency. (Other news sources and exchanges may be used as well.) Some have been recalibrated by Jim Miekka to reduce statistical noise and make the indicator a more reliable predictor of a future decline.

1.The daily number of NYSE new 52 week highs and the daily number of new 52 week lows are both greater than or equal to 2.8 percent (this is typically about 84 stocks) of the sum of NYSE issues that advance or decline that day (typically, around 3000).[2] An older version of the indicator used a threshold of 2.5 percent of total issues traded (approximately 80 of 3200 in today's market).

2.The NYSE index is greater in value than it was 50 trading days ago. Originally, this was expressed as a rising 10 week moving average, but the new rule is more relevant to the daily data used to look at new highs and lows.

3.The McClellan Oscillator is negative on the same day.

4.The number of New 52 week highs cannot be more than twice the number of new 52 week lows (though new 52 week lows may be more than double new highs).

The traditional definition requires each condition to occur on the same day. Once the signal has occurred, it is valid for 30 days, and any additional signals given during the 30-day period should be ignored. During the 30 days, the signal is activated whenever the McClellan Oscillator is negative, but deactivated whenever it is positive.[2]

Some users of the omen may choose to view the 30 day limit as "working days" and not "calendar days", arguing that the global finance market works on a weekday (Monday to Friday) schedule—leaving about 100 hours where only limited sharemarket trading takes place.

As a rule, the shorter the time-frame in which the conditions listed above occur, and the greater the number of conditions observed in that time frame, the stronger the Hindenburg Omen. If several --but not all-- of the conditions are repeatedly observed within a few weeks, that is a stronger indicator than all of the conditions observed just once during a 30-day period[3].

criteria;

These criteria are calculated daily using Wall Street Journal figures from the New York Stock Exchange for consistency. (Other news sources and exchanges may be used as well.) Some have been recalibrated by Jim Miekka to reduce statistical noise and make the indicator a more reliable predictor of a future decline.

1.The daily number of NYSE new 52 week highs and the daily number of new 52 week lows are both greater than or equal to 2.8 percent (this is typically about 84 stocks) of the sum of NYSE issues that advance or decline that day (typically, around 3000).[2] An older version of the indicator used a threshold of 2.5 percent of total issues traded (approximately 80 of 3200 in today's market).

2.The NYSE index is greater in value than it was 50 trading days ago. Originally, this was expressed as a rising 10 week moving average, but the new rule is more relevant to the daily data used to look at new highs and lows.

3.The McClellan Oscillator is negative on the same day.

4.The number of New 52 week highs cannot be more than twice the number of new 52 week lows (though new 52 week lows may be more than double new highs).

The traditional definition requires each condition to occur on the same day. Once the signal has occurred, it is valid for 30 days, and any additional signals given during the 30-day period should be ignored. During the 30 days, the signal is activated whenever the McClellan Oscillator is negative, but deactivated whenever it is positive.[2]

Some users of the omen may choose to view the 30 day limit as "working days" and not "calendar days", arguing that the global finance market works on a weekday (Monday to Friday) schedule—leaving about 100 hours where only limited sharemarket trading takes place.

As a rule, the shorter the time-frame in which the conditions listed above occur, and the greater the number of conditions observed in that time frame, the stronger the Hindenburg Omen. If several --but not all-- of the conditions are repeatedly observed within a few weeks, that is a stronger indicator than all of the conditions observed just once during a 30-day period[3].

Last edited:

Week of the truth , correction or up ,Fed week.

The market has been trying to take out the 1687-1709 region for about 4 months now

The market has been trying to take out the 1687-1709 region for about 4 months now

Week of the truth , correction or up ,Fed week.

The market has been trying to take out the 1687-1709 region for about 4 months now

The market is in a very strong position and I would think Sunday night the banks ramp the futures. It is possible that we rally into October and make top,whether that is final,I don't know,when never does.

I hope not , im shorting the market

You poor bastard,been there done that

I think he's from Boston; though here, we usually signal one way and turn the other.

We call it a "hook turn" here in Melbourne

Ole Yellen is a inflationist that makes Bernanke look like Franz Pick

But let's see how this turns out...... SPX low 666.79 x 2.618 = 1745.65

Ole Yellen is a inflationist that makes Bernanke look like Franz Pick

People were warning for years that Bernanke's policies would lead to high inflation too and they never did. But the same chime keeps coming back whether or not it's what happened.

I think we have made a major top , i think/hope we will bottom out at 1100 spx at expiration late oct [ however there never rings a bottom bell]

the wednesday 1730 was in my opinion a ''false move'' up.

Just like the 1073 move late sept 2011, that was a false move down and it went up after that

In my opinion the fed is/gets boxed in , solving a debt problem with more debt, if bond yields rise from here on , the party is over

http://www.europac.net/commentaries/taper_wasnt

the wednesday 1730 was in my opinion a ''false move'' up.

Just like the 1073 move late sept 2011, that was a false move down and it went up after that

In my opinion the fed is/gets boxed in , solving a debt problem with more debt, if bond yields rise from here on , the party is over

http://www.europac.net/commentaries/taper_wasnt

- Status

- Not open for further replies.

Similar threads

- Replies

- 2

- Views

- 1K

- Replies

- 23

- Views

- 6K

- Replies

- 133

- Views

- 23K

- Replies

- 10

- Views

- 5K

| Steve Williams Site Founder | Site Owner | Administrator | Ron Resnick Site Owner | Administrator | Julian (The Fixer) Website Build | Marketing Managersing |